Avoid These Mistakes When Crafting Your Finance Career Plan

[ad_1]

Feeling stuck in your finance career? Or maybe you’re feeling the pressure to rush into that next promotion because, well, isn’t that the whole point of climbing the corporate ladder?

I’ve been there.

It’s easy to get caught up in title-chasing—thinking that bigger equals better, faster equals smarter, and that if you’re not moving up constantly, you’re standing still. But here’s the cold, hard truth: climbing the ladder too quickly isn’t everything it’s cracked up to be. It might even be the thing that derails your career in the long run.

I’ve seen it happen over and over again—people leaping from role to role, grabbing fancy titles without building the skills to back them up. Inevitably, cracks start to show. A lack of experience. Gaps in knowledge.

Suddenly, they’re in over their heads, and their rapid rise starts to feel more like freefall. That’s why I’m here to tell you that the real secret to finance career success isn’t a race to the top. It’s about becoming a T-shaped professional.

This guide is your go-to resource for rethinking how you approach career growth in finance. Together, we’ll walk through a step-by-step plan to help you assess your skills, make smarter career moves, and avoid common pitfalls.

Along the way, I’ll share real-life case studies to show you exactly what works—and what doesn’t. Whether you want to avoid career burnout, build a skillset that opens doors, or just figure out how to time your next move, this is the advice you need.

The Proven Path to Finance Success (Hint: It’s NOT Fast Promotions)

What’s Wrong with Chasing Titles?

Look, I get it. A fancy title on your LinkedIn profile feels like a win. It’s easy to think that moving up the ladder as quickly as possible means you’re “making it.” But chasing promotions without building the skills to back them up? That’s a ticking time bomb for your career, trust me. I’ve seen it happen, and it’s not pretty.

The Pitfalls of Moving Up Too Fast

First off, climbing too quickly often means taking on responsibilities you’re not ready for. Imagine this scenario—you finally snag that coveted manager role, only to realize you have zero idea how to manage people. Suddenly, you’re drowning in team issues, and your lack of leadership experience is painfully obvious to everyone, including your team. What started as a dream promotion quickly morphs into a full-blown nightmare.

Or think about stepping into a senior role in an area you don’t fully understand. You might have wowed people enough to get the position, but now you’re expected to lead complex projects and make strategic decisions when you’re still learning the basics yourself. That gap in knowledge? Yeah, it doesn’t go unnoticed.

Honestly, an obsession with titles can lead to a massive skills deficit. You’re so busy moving up that you don’t take the time to dig deep into one area or learn the ins and outs of other parts of the business. Eventually, this catches up with you. The higher the role, the more exposed your weak points become.

A Real-Life Crash-and-Burn Story

One of my old colleagues learned this lesson the hard way. She was a fast-tracker, jumping between finance jobs, securing bigger titles with each move. On the surface, she seemed unstoppable. But then the company brought in a restructuring initiative. Her department merged with another, and she was asked to lead a cross-functional team. Sounds like a huge opportunity, right?

Here’s the issue—she’d never taken the time to build breadth in her skillset. She lacked knowledge about the systems and processes in the other department, and her so-called leadership role quickly unraveled. The team didn’t trust her judgment, her deadlines slipped, and eventually, she was moved out of the role entirely. Her career plateaued after that, all because she’d prioritized titles over groundwork.

Skill vs. Title

Here’s the truth companies won’t put on a job posting—they care about impact, not inflated titles. When leadership evaluates you, they’re not just looking at your position. They’re asking, “What value does this person bring to the table?”

If you’re all title and no depth, you’re at risk during reorganizations or downturns. Why? Because titles without results make you replaceable. But when you’ve got the skills to adapt and the expertise to provide real solutions, you become the person everyone looks to in challenging times.

This brings me to the million-dollar question you need to answer for yourself: Are my current skills strong enough to stand out in a room full of senior titles?

Take a beat. Be honest. If the answer isn’t a resounding yes, it’s time to rethink your priorities. Because at the end of the day, a meaningful, impactful career beats a shiny new LinkedIn headline every single time.

What is a T-Shaped Corporate Finance Professional?

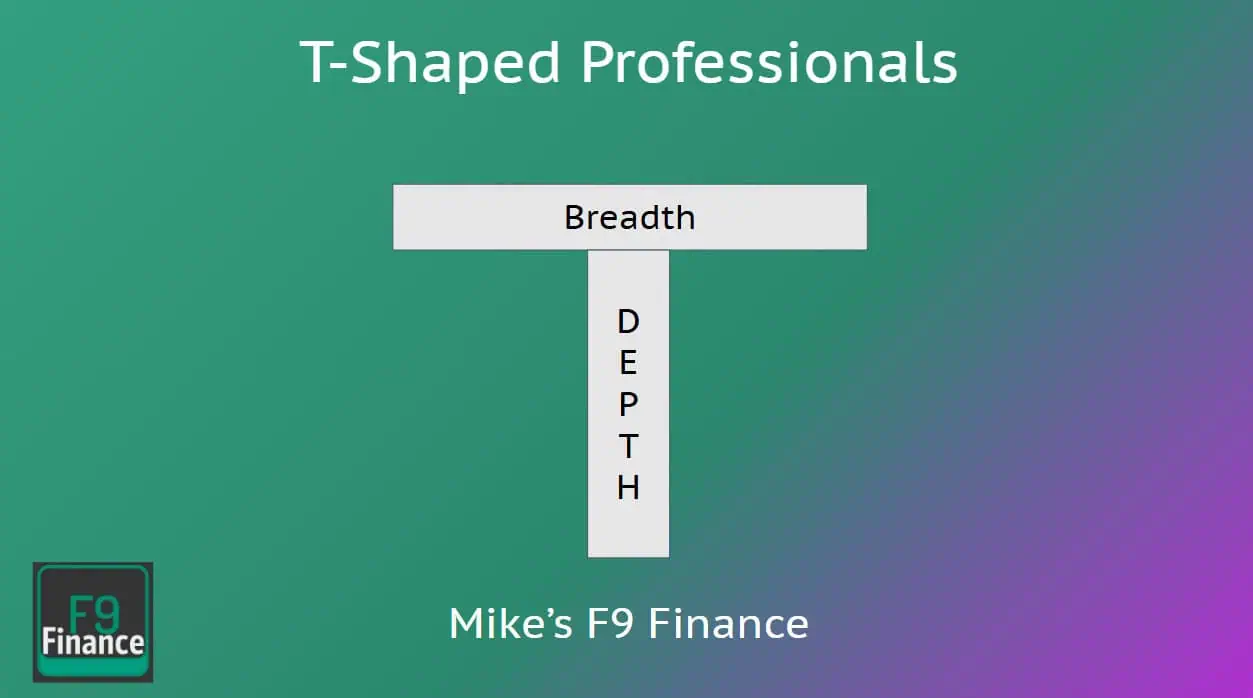

If you’re wondering what the heck a “T-shaped professional” actually is, don’t worry—you’re not alone. When I first heard the term, I thought it sounded like something out of a geometry textbook. But here’s the deal—it’s one of the smartest ways to think about your career growth.

A T-shaped professional is someone with deep expertise in a specific area (the vertical part of the “T”) and broad knowledge across different disciplines (the horizontal part). And in the finance world, this combination is a total game-changer.

Breaking Down the T-Concept

Picture a capital T. The vertical line represents your depth—this is where you’ve mastered your craft. Maybe you’re the go-to person for FP&A (Financial Planning & Analysis), treasury, or tax strategy. If someone throws a question your way in this area, you’ve got the answer—or at least know exactly how to get it. This depth makes you trustworthy in your niche and ensures you can handle deep, technical challenges.

Now, the horizontal bar is your breadth. This is where you’ve explored other functions in finance and picked up a general understanding of areas like budgeting, forecasting, auditing, strategy, or even softer skills like project management. It’s not about mastering everything—it’s about knowing enough to collaborate effectively with different teams, spot patterns others overlook, and adapt when things go sideways.

For example, maybe you specialize in treasury, but you’ve also learned enough about corporate budgeting and cash flow management to work collaboratively with an FP&A team. That breadth gives you the flexibility to step into cross-functional projects and actually add value beyond your core expertise.

Why It Matters

Here’s the magic of being T-shaped—it makes you adaptable in ways most people aren’t. Think of the finance landscape today. Technology is changing how we do our jobs, business models are evolving fast, and suddenly, what worked five years ago feels ancient. A T-shaped professional thrives in this chaos. They can pull insights from different areas, connect the dots that others miss, and step into new roles or challenges without skipping a beat.

I once worked with someone who nailed this approach. She started her career as a financial analyst and went deep into forecasting—it was her bread and butter. But instead of stopping there, she took on a rotation in corporate strategy, jumped into a short-term role in auditing, and even dabbled in investor relations.

When her company started a massive transformation project, guess who they tapped to lead it? Yep—her. She had the forecasting chops to ground decisions in data, the strategy exposure to connect the project to broader business goals, and the communication skills to rally the leadership team behind her vision. By the end of the project, her name was cemented as one of the company’s top change-makers. That’s the power of breadth meeting depth.

A Quick Reality Check

Here’s where I ask you the hard question. Take a moment to think about your own career. Is your horizontal bar strong enough? Do you have the range to explore new opportunities or transition into a completely different role if needed? Or are you leaning too hard on your vertical line?

Step-by-Step Guide To Building A Finance Career Plan

If you’re ready to take control of your finance career and build something sustainable—and dare I say, enviable—then this step-by-step guide is your playbook. The goal? To plan a career that’s not just about climbing the ladder but about becoming the ultimate T-shaped finance professional. Trust me, it’s worth the effort.

Step 1. Assess Your Current Skills

First things first, you need to know where you stand. Picture this like mapping out your “T.” Start by identifying your vertical (the area where you’re deeply specialized) and your horizontal (all the other areas you’ve dabbled in but haven’t mastered yet).

Here’s how I tackle this. Make a simple checklist of key finance functions—FP&A, audit, tax, forecasting, treasury, management reporting, etc. Rate yourself on a scale of 1 to 5 for each, with 1 being “I can vaguely explain what this is” and 5 being “I could teach a masterclass on this.”

Better yet, sketch this out in a worksheet. Visualize your skill gaps and strengths. If one area—say, financial modeling—is your vertical, great. But if your horizontal bars look bare, that’s your signal to start filling them in.

Step 2. Build Your Depth

Your vertical bar is your bread and butter. This is the skill that makes you indispensable. If you don’t have a specialization yet, it’s time to pick one. Maybe it’s FP&A, maybe it’s mergers and acquisitions, or maybe you’re the forecasting guru every CFO dreams of working with. The key is going deep.

How do you sharpen your focus? Tap into multiple resources. Find a mentor who’s already mastered the area you’re targeting. Take an online course or certification that fills your knowledge gaps. Volunteer for projects on the job that stretch your expertise.

I once knew a finance analyst who carved out a niche by absolutely nailing data visualization. Her reports weren’t just numbers on a page—they told a story that clients and execs could actually understand. This mastery turned her into a go-to resource for high-impact presentations, and eventually, it got her a well-deserved promotion. Depth matters.

Step 3. Expand Your Horizons

You’ve got your vertical bar down—that deep specialization that makes you a rockstar. Now it’s time to widen your skillset. One of the best ways to do this is by switching roles within your finance organization. Moving from FP&A to treasury, or audit to strategy, for example, exposes you to entirely new systems, challenges, and ways of working.

The magic here lies in transferable skills. Say you’re an FP&A specialist and you make the leap to a more operational role in treasury. You’ll bring with you some killer forecasting expertise that could elevate your team’s ability to plan cash flow. Meanwhile, you’ll build new skills in liquidity management that round out your overall finance toolkit.

I worked with someone who pulled this off beautifully. She started in internal audit, a role she admittedly didn’t love, but used it to deeply understand internal controls. Then, she made a jump into corporate strategy, leveraging those skills to lead risk assessments on massive M&A deals. She became the go-to expert for identifying red flags, and as an added bonus, she found her niche. That horizontal growth totally leveled up her value.

Step 4. Support Different Types of Businesses

Here’s where things get really interesting. If you want to build resilience and adaptability, try working across industries. Finance in tech will challenge you to think at high-speed, while finance in retail sharpens your understanding of long-term cash cycles. Different industries, different mindsets—the experience fundamentally changes how you tackle problems.

When I made the leap from working in manufacturing to tech, I thought the learning curve would crush me. Honestly, it was brutal at first. But figuring out how a subscription revenue model works compared to an inventory-centric model expanded the way I approach financial strategy. Suddenly, I could adapt to nearly any business model.

Not sure how to start branching out? Look for opportunities within your current organization. Many companies encourage cross-industry projects or allow employees to try new functions through job rotations. Or, step outside entirely by networking at industry events to sniff out roles in industries you’re not familiar with. The discomfort is worth the payoff.

Step 5. Time Your Moves in Your Corporate Finance Career Path

This one’s tricky but crucial—knowing when to stick with a role versus when to move on. Here’s the thing, there’s absolutely no shame in staying put long enough to master your current gig, but there’s also a fine line between mastering and stagnating.

A good indicator it’s time to move on? You’re no longer learning. Every day feels like Groundhog Day, tasks are on autopilot, and no new challenges are coming your way. On the flip side, don’t jump ship too early either. Leaving without a measurable track record of success undermines your career story. You want to leave a role with clear proof of impact.

When I was ready to leave an FP&A role, I first made sure to document the improvements I’d made—process overhauls, reporting automation—the works. When I went to my next gig, I wasn’t just another hire; I was the person who’d left a legacy of change at my previous company. That’s how you graduate from roles on a high note.

Networking and Staying Ahead

In the fast-paced world of finance, networking and staying ahead of industry trends are essential for career success. Building relationships with other finance professionals can open doors to job opportunities, mentorship, and valuable resources. Networking isn’t just about exchanging business cards; it’s about creating meaningful connections that can support your career growth.

Career Outlook for Corporate Finance Professionals

The career outlook for corporate finance professionals is promising. According to the Bureau of Labor Statistics, employment of financial managers is projected to grow 16% from 2020 to 2030, which is significantly faster than the average for all occupations. This growth is driven by the increasing complexity of financial regulations and the need for companies to manage their financial resources more effectively.

Corporate finance professionals can find opportunities in a wide range of industries, including banking, investment, and financial services. The skills acquired in corporate finance are highly transferable, allowing professionals to move between different sectors and roles. From financial analysts to chief financial officers, the career paths in corporate finance are diverse and rewarding. With the right mix of expertise and experience, finance professionals can look forward to a dynamic and fulfilling career.

Networking in the Finance Industry

Networking in the finance industry involves connecting with a diverse group of professionals, including financial analysts, investment bankers, and corporate finance professionals. Attending industry events, joining professional organizations, and participating in online forums are all effective ways to build your network.

Some popular networking events in the finance industry include Financial Planning Association (FPA) conferences, CFA Institute conferences, and various investment banking and corporate finance conferences. These events provide opportunities to learn from industry leaders, share best practices, and stay up-to-date on the latest trends.

Professional organizations such as the Financial Planning Association (FPA), Chartered Financial Analyst Institute, Investment Banking Association, and Corporate Finance Association offer additional networking opportunities. Membership in these organizations can provide access to exclusive events, educational resources, and a community of like-minded professionals.

Online forums, such as LinkedIn groups, Reddit forums, and finance-specific subreddits, are also valuable for networking. These platforms allow you to engage with finance professionals from around the world, share insights, and seek advice on career-related topics.

By actively participating in these networking opportunities, you can stay informed about industry developments, gain new perspectives, and build a support system that can help you navigate your finance career.

Common Mistakes & How to Avoid Them

Building a strong finance career isn’t just about what you do—it’s about what you don’t do. I’ve seen brilliant professionals stumble over some common traps, so here’s your heads-up. Spoiler alert: comfort zones, shiny titles, and tunnel vision are your biggest enemies.

Mistake #1. Staying Too Comfortable

Ah, the comfort zone. It’s cozy, predictable, and utterly disastrous for your growth. Don’t get me wrong, mastering your current role is important—if you’re still learning, stay put. But if you’ve spent years in the same function without stretching yourself, you’re not just comfortable—you’re stagnant. And in finance, where adaptability is king, stagnation is a career killer.

How do you make a move without tanking your momentum? Start with a calculated plan. Look for lateral or even entry-level opportunities in adjacent functions. Been working FP&A forever? Try stepping into treasury or audit. The goal is to expand your skillset while still leveraging your existing expertise.

I sat down once with a treasury professional who stayed in her lane for nearly a decade. She was great at her job but had no clue how to step into a broader strategy role when the company restructured. Talk about a wake-up call. Lesson here: staying in one lane may feel easy at first, but it puts your long-term career resilience at risk.

Mistake #2. Chasing Titles Without Considering Skills

We all want to climb the ladder. But can we talk about how the “Director” or “VP” title means zilch if you’re not ready for it? I’ve seen people take promotions they weren’t equipped to handle, only to crash and burn when the expectations didn’t match their skillset. And yeah, it’s awkward—and avoidable.

Here’s the reality check: a title that outpaces your skillset is a mirage. What’s worse, it can leave you exposed when tough times hit, like layoffs or reorganizations. Be smart about accepting (or declining) promotions. Frame it strategically—say something like, “I want to do this role justice, but I’d like to focus on X skills first to make a real impact.” Trust me, this shows maturity and won’t burn bridges.

One former colleague of mine went from financial analyst to VP in a flash (thanks to a hiring spree). Sounds like a win, right? Wrong. When push came to shove, she couldn’t deliver in a senior role. After one too many missteps, she was back at square one. The takeaway? Growth > Titles. Every. Single. Time.

Mistake #3. Ignoring the Horizontal Bar of Your T

Specialization can make you a star, but over-specialization? That makes you replaceable. Imagine you’ve poured everything into FP&A, but have zero clue about strategy or treasury. What happens when the industry evolves, and your niche isn’t as in-demand? Spoiler alert—it gets messy.

I once met a finance manager who’d been deeply entrenched in cost analysis for years. She decided to take a scary (yet smart) leap into strategy and learned transferable skills like stakeholder management and competitive analysis. Not only did she kill it in the new department, but she also became the bridge between her old and new teams. Her diversified experience made her indispensable. That’s the power of a strong horizontal bar.

Diversifying isn’t just about security—it’s about seeing opportunities others miss. Take the leap into something new, gain exposure to different functions, and flex those transferable skills. Because at the end of the day, a thin horizontal bar is just a liability waiting to happen.

[ad_2]