How Long Does a Credit Card Judgment Last in Florida?

[ad_1]

How Long Does a Credit Card Judgment Last in Florida?

If you’ve found yourself in a lawsuit, you may have lost, and a judgment might be pressed against you.

In such a case, the judgment creditor could use a judgment lien certificate to claim a lien on your property.

But how long does this judgment stand?

While filing for bankruptcy can often discharge such judgments, is it really wiser to simply “wait it out” until the judgment is no longer valid and enforceable in court?

If you want to know more about Credit Card judgment in Florida, keep reading! But first, let me show you the overview of this judgment.

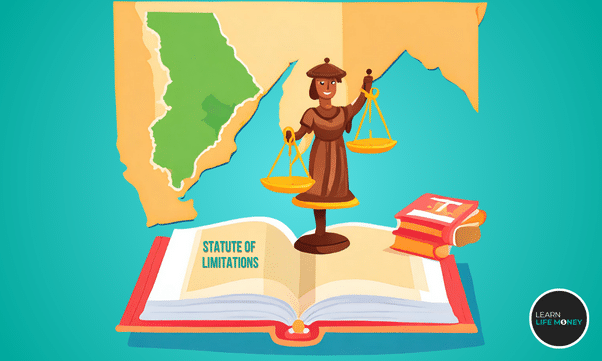

Understanding the Statute of Limitations for Florida Debt

In Florida, Florida Statutes Section 95.11 outlines the statute of limitations for credit card debt.

The statute specifies that creditors must commence actions to collect a debt within five years from the time the cause of action accrues.

Regarding credit card debt, the cause of action typically accrues on the date of the last payment or charge on the account.

This means that creditors have five years from that date to file a lawsuit to collect the debt.

If they do not file a lawsuit within this time frame, they lose their legal right to do so.

It’s important to note that the statute of limitations applies to the legal remedy of filing a lawsuit to collect the debt.

It doesn’t prevent creditors from attempting to collect the debt through other means, such as contacting you by phone calls or mail.

However, if the statute of limitations has expired, you can assert it as a defense if a creditor sues you for the debt.

Also worth noting is that the statute of limitations can be extended or tolled (suspended) under certain circumstances.

For example, if you acknowledge the debt in writing or make a partial payment, you may reset the statute of limitations.

Keep in mind that phone calls from the debt collector and other creditors may be part of the public record.

During this time period, especially if there has been a court judgment or final judgment, including a default judgment.

Now, what is a Judgment Lien?

Judgment lien certificates are part of public records and are available to the public.

They provide notice that the judgment creditor has a lien on the debtor’s real property.

If the judgment debtor tries to sell the property, the certificate ensures that the judgment creditor will be paid from the sale proceeds.

If the judgment creditor wants to enforce the judgment through a sale of the debtor’s real property, the creditor must first obtain a writ of execution from the court.

The writ of execution directs the sheriff to seize and sell the debtor’s personal property to satisfy the judgment.

The sale is conducted at a public auction, and the proceeds are used to pay off the judgment.

If the judgment creditor knows where the debtor works, the creditor can also obtain a writ of garnishment to garnish the debtor’s wages.

A writ of garnishment directs the debtor’s employer to withhold a portion of the debtor’s wages and pay it to the judgment creditor.

Judgment creditors can also use writs of garnishment to garnish the debtor’s bank accounts or other assets.

It’s important to note that different types of debt can result in civil judgments.

These judgments can have serious consequences for the debtor.

This includes the possibility of wage garnishment, bank account garnishment, and liens on real property.

If you have questions about a civil judgment or how it may affect you, it’s a good idea to speak with a legal professional.

What is the length of a judgment lien in Florida?

Enforcing a judgment can last up to 20 years, which may seem like a long time—and it is!

While technically possible to renew judgments after 20 years, this is rare due to their complexity and inconsistency.

Florida law, specifically section 55.081 of the Florida Statutes, dictates the duration of a judgment.

This law outlines how long a judgment creditor can pursue the judgment debtor’s property through civil judgments in state court.

It’s important to note that federal law also plays a role in enforcing judgments.

Also, compliance with a court order and decrees of any court is essential for both creditors and debtors.

Some real estate liens, such as mortgages, remain valid until the underlying debt is paid.

As previously mentioned, the statute of limitations for collecting a debt in Florida is 20 years.

A judgment lien on Florida property, based on an underlying money judgment, expires ten years after recording a certified copy of the judgment in the county where the property is located.

A creditor can re-record the judgment and extend the lien for a further ten years.

What happens if a creditor doesn’t re-record a judgment in Florida?

If the creditor fails to re-record the judgment by statutory rules, the Florida judgment lien will automatically expire after ten years.

Different statutes of limitations apply to debts, including those arising from oral contracts.

Unpaid debt can lead to a court date, where the best ways to resolve the issue may be discussed.

This may involve a court hearing or, in some cases, a jury trial.

During this period of time, it’s important to adhere to the Fair Credit Reporting Act, which regulates the collection and use of credit information.

A written statement may be required, especially if the old debt is being disputed in court.

This process can result in a decree of any court, including those in the United States, which may have jurisdiction over the matter.

Does a judgment become a lien on a Florida homestead?

In Florida state law, a credit card judgment typically does not automatically become a lien on a homestead property.

Florida’s homestead laws offer protections for primary residences from certain types of judgments and creditors, including credit card judgments.

However, there are exceptions to this rule such as judgments related to the purchase or improvement of the homestead property, certain tax liens, and obligations for labor or materials used in improving the property.

That is why it’s still important to consult with a legal professional for specific advice regarding your situation.

Steps to Resolve a Judgement

There are only four steps to remove a judgment:

- Pay the judgment in full.

- Settle the judgment with the creditor.

- Discharge the judgment through bankruptcy.

- Wait out the judgment’s twenty-year life.

If you are unable to pay the judgment, the creditor may take legal action to collect the debt.

This could involve hiring a collection agency or filing a debt collection lawsuit.

In response, you may have the option to file a claim of exemption if you believe your income or property is exempt from collection.

If you don’t have enough amount of money, you may also consider filing for bankruptcy.

Bankruptcy proceedings are handled in bankruptcy court and can help you eliminate or restructure your debts.

It’s important to understand the implications of each option.

You can seek advice from a legal professional or the Department of State if you are unsure.

Most of them give a free consultation at first.

Additionally, be aware that certain debts, such as car loans or open-ended accounts, may have different rules or consequences.

Partial payments on outstanding debts could also impact the judgment and its collection.

Final Thoughts on Credit Card Judgment Last in Florida

When considering the duration of a credit card judgment in Florida, several factors come into play.

The Florida Statute of Limitations sets a time frame within which creditors can sue debtors for outstanding debts.

For credit card debts, this statute generally runs for five years from the date of the last payment or the last activity on the account.

However, making a partial payment or acknowledging the debt in writing can restart the clock on the statute of limitations.

Also, it’s important to note that the Florida Constitution protects a debtor’s primary residence (homestead property) from certain types of judgments, including credit card judgments.

This can be good news for a Florida resident facing credit card debt issues.

If a creditor does obtain a judgment, it typically lasts for 20 years in Florida.

However, this can vary based on the type of debt and whether there was a written contract involved, such as with car loans.

At the end of the day, consulting with a legal professional or seeking legal advice can provide clarity on how long a credit card judgment may last.

They can tell you what actions you may take to address it within the state’s own statute of limitations.

Frequently Asked Questions About Credit Card Judgment in Florida

How long does a credit card judgment last in Florida?

In the state of Florida, a credit card judgment can last for up to 20 years from the date it is entered by the court.

This means that the creditor has the right to attempt to collect the debt for that period.

However, it’s important to note that the creditor must renew the judgment before the end of the 20 years to continue collection efforts.

Can a credit card judgment be renewed in Florida?

Yes, a credit card judgment can be renewed in Florida.

The creditor can file a motion with the court to renew the judgment before it expires.

If the court grants the motion, it will extend the judgment for another 20 years.

It allows the creditor to continue collection efforts.

What happens if a credit card judgment expires in Florida?

If a credit card judgment expires in Florida, it means that the creditor can no longer legally collect the debt through the court system.

However, the debt still exists, and the creditor may still attempt to collect it through other means, such as contacting the debtor directly or selling the debt to a collection agency.

Can a credit card judgment be removed from a credit report in Florida?

Yes, a credit card judgment can be removed from a credit report in Florida.

If you pay the judgment in full, it requires the creditor to file a satisfaction of judgment with the court.

Once they file a satisfaction of judgment, the debtor can request that the credit bureaus remove the judgment from their credit report.

Can a credit card judgment affect my ability to buy a home in Florida?

Yes, a credit card judgment can affect your ability to buy a home in Florida.

A judgment is a public record and can appear on your credit report, which can lower your credit score.

A lower credit score can make it more difficult to qualify for a mortgage or may result in higher interest rates.

Additionally, if the judgment is not satisfied, the creditor may place a lien on your property, including your home, which could prevent you from selling or refinancing the property.

Can a credit card judgment be discharged in bankruptcy?

Yes, bankruptcy can discharge a credit card judgment.

When you file for bankruptcy, the automatic stay typically halts all delinquent debt collection actions, including those related to a credit card judgment.

If the debt qualifies for discharge and you include it in your bankruptcy petition, the court may discharge the debt, relieving you of the legal obligation to pay it.

However, certain debts, such as those arising from fraud or certain taxes, may not be dischargeable.

How long does a bankruptcy stay on my credit report in Florida?

In Florida, a bankruptcy can stay on your credit report for up to 10 years from the date of filing, depending on the type of bankruptcy you file.

Chapter 7 bankruptcy, which involves liquidation of assets, remains on your credit report for up to 10 years from the filing date.

Chapter 13 bankruptcy, which involves a repayment plan, remains on your credit report for up to 7 years from the filing date.

What happens to a credit card judgment if I declare bankruptcy in Florida?

If you declare bankruptcy in Florida, the court may discharge the credit card judgment along with other qualifying debts.

Once the court discharges the debt, the creditor is no longer allowed to pursue collection actions against you for that debt.

Additionally, the bankruptcy filing may also impact the creditor’s ability to enforce the judgment, such as placing a lien on your property.

However, it’s important to note that bankruptcy laws are complex, and the specific implications can vary based on individual circumstances.

It’s advisable to seek guidance from a legal professional experienced in bankruptcy law for advice tailored to your situation.

[ad_2]