How To Automate Financial Reports The Easy Way

[ad_1]

I’m all about automating financial reports because, let’s face it, life is too short to be stuck in Excel hell. Learning to automate financial reports isn’t just about making things easier; it’s about transforming your entire approach to finance, freeing up time for the stuff that really matters—like strategic thinking or even just a well-deserved coffee break.

Let me take you back to my first encounter with automation. Picture this: a mountain of spreadsheets, deadlines breathing down my neck, and a coffee pot that was working overtime. It was chaos, pure and simple.

But then, I discovered a financial reporting automation tool. It was like finding an oasis in the desert. Suddenly, what used to take hours was done in minutes, and my sanity was saved. From that moment on, I was hooked. Automation didn’t just change the way I worked; it changed the way I lived.

What is Financial Reporting Automation?

Financial reporting automation is the use of advanced software and technology to streamline the preparation and presentation of financial information. Instead of relying on manual data entry and the risk of human error, automated tools handle the heavy lifting.

These systems collect, analyze, and present financial data with precision, allowing finance teams to focus on strategic tasks rather than getting bogged down in repetitive processes. By automating financial reporting, organizations can enhance the accuracy of their financial statements, reduce the time spent on data collection, and improve overall efficiency. It’s like having a tireless assistant who ensures your financial data is always up-to-date and error-free.

Benefits of Automating Financial Reports

Let’s dive into the wonders of automating financial reports and why you should be as excited about it as I am. First up, we have the Time-Saving Magic. Imagine a world where those endless hours spent manually compiling reports are now yours to reclaim. Automation steps in, handling the grunt work, so you can focus on strategic tasks or even enjoy an extra coffee break. It’s like gaining time without time travel.

Next, let’s talk about Accuracy and Reliability. We all know the horror of spotting a tiny error that throws off an entire report. With automation, those pesky human errors become a thing of the past. It’s like having a personal assistant who never gets tired, ensuring precision with every report.

Then there’s the beauty of Real-Time Insights. Picture having access to the freshest data any time you need it, without waiting for manual updates. Automation keeps you plugged into the latest numbers, empowering you to analyze financial data and make informed decisions on the fly. It’s like having a crystal ball for your financials.

Finally, let’s discuss Cost Efficiency. By cutting down on manual labor, automation slashes overhead costs and boosts efficiency. It’s like putting your finances on a diet and watching the excess waste disappear. You save money while getting more done—talk about a win-win!

In sum, automating financial reports isn’t just a tech upgrade; it’s a game-changer that lets you work smarter, not harder.

Tools and Software for Financial Reporting Automation

When it comes to automating financial reports, choosing the right tools and software is crucial. Let’s start with some Top Software Picks. There’s a wide array of options out there, from trusty Excel add-ons that extend the capabilities of your favorite spreadsheet program, to sophisticated cloud-based solutions like QuickBooks and Xero that offer dynamic, real-time updates.

For larger enterprises, platforms like SAP or Oracle Financials provide comprehensive solutions to handle complex reporting needs. Each of these tools brings its own set of features, so there’s something for everyone. Additionally, financial reporting software can automate tasks such as generating income statements, cash flow statements, and balance sheets, making it easier for small and mid-sized businesses to manage their finances.

Now, let’s tackle the process of Choosing the Right Tool for You. This decision hinges on a few key factors. First, consider your budget. While some tools offer free versions or trial periods, others might require a significant investment.

Next, think about the size of your company. A small business might thrive with a simple tool, while a larger corporation may require a more robust system. Finally, assess your specific needs. Are you looking for basic reporting, or do you need advanced analytics and forecasting capabilities? Matching your needs with the right tool can make all the difference.

Once you’ve selected your tool, it’s time to focus on Implementation Tips. Getting your team on board is essential for a smooth transition. Start by clearly communicating the benefits of automation, such as increased efficiency and accuracy, to get everyone excited about the change.

Emphasize how financial statement analysis will be enhanced, allowing for more detailed and transparent reports. Provide comprehensive training sessions to ensure everyone feels confident using the new software. Lastly, encourage feedback and be open to adjustments. Remember, it’s about making your team’s life easier, not just changing processes for the sake of it.

By carefully selecting and implementing the right tools, you’ll be well on your way to financial reporting nirvana, with a team that’s not just on board, but enthusiastic about the journey ahead.

Step-by-Step Guide to Automate Financial Reports

Embarking on the journey to automate your financial reports? Let’s break it down step-by-step, so you can streamline your processes and enjoy the perks of automation.

Step 1: Assess Your Current Process

First things first—take a good look at what you’re working with. Evaluate your existing systems and understand your current report requirements. This will help you identify areas ripe for automation and give you a clear starting point.

Step 2: Define Your Objectives

Next, get clear on what you want to achieve. Do you want to cut down on time spent? Improve accuracy? Or maybe both? Pinpointing your goals will guide your automation journey and help you measure success.

Step 3: Select the Right Tools

Now that you know what you need, it’s time to match those needs with the best software options. Whether it’s an Excel add-on or a comprehensive cloud-based solution, choose a tool that aligns with your objectives and company size.

Step 4: Data Collection and Integration

With your tools in hand, it’s time to connect the dots. Seamless data integration is crucial for a smooth transition. Ensure all your data sources are connected to avoid any bottlenecks down the road.

Step 5: Set Up and Customize Templates

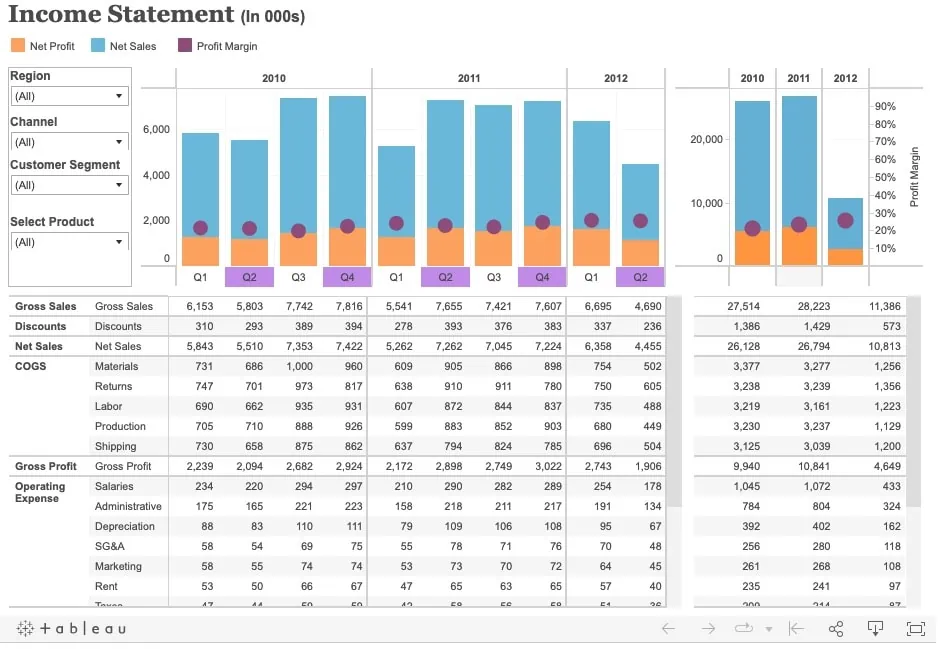

Here’s where the fun begins—setting up and customizing your report templates, including income statements. Tailor them to fit your specific needs, ensuring they’re not just functional but also visually appealing. Goodbye, cookie-cutter reports!

Step 6: Test and Validate

Before you hit the ground running, it’s vital to test and validate your setup. Make sure everything operates smoothly, like a well-oiled machine. This step is crucial to ironing out any kinks before full implementation.

Step 7: Train Your Team

Automation is only as good as the people using it. Organize training sessions to ensure your team is on board and confident in using the new system. The goal is to make their lives easier, not more complicated.

Step 8: Monitor and Adjust

Once you’re up and running, keep a close eye on performance. Monitor the reports and be ready to make tweaks as needed. Continuous improvement is the name of the game, ensuring your reporting remains top-notch.

By following these steps, you’ll transform your financial reporting process, gaining efficiency, accuracy, and perhaps a bit of extra sanity—who doesn’t want that?

Real-Life Case Studies

Let’s dive into some real-life tales that showcase the magic of automating financial reports. These stories highlight the transformative power of automation, whether you’re running a cozy corner bakery or steering a global giant.

Case Study 1: Small Business Success Story

Meet the charming local bakery that was once knee-deep in financial chaos. With stacks of invoices and receipts piling up, their monthly reporting was more of a headache than a help. Enter automation. By adopting a simple cloud-based solution, this bakery was able to streamline their invoicing and sales tracking.

The result?

They cut down their report preparation time by 70%, allowing the owner to focus more on whipping up delicious pastries rather than drowning in paperwork. The clarity in their finances also helped identify peak sales periods, which led to strategic marketing campaigns and a sweet boost in revenue. Who knew automation could be the secret ingredient to their success?

Case Study 2: Corporate Transformation

Now, let’s take a look at a multinational corporation that was trapped in a web of manual madness. With countless subsidiaries and a labyrinth of spreadsheets, their reporting process was a nightmare. Recognizing the need for change, they embarked on an ambitious journey to automate their financial reporting. The challenges were significant—finding the right tools, integrating diverse data sources, and training a global team. However, the payoff was worth it.

The transition to a robust enterprise software, specifically a financial reporting automation tool, not only slashed report generation time by half but also enhanced data accuracy across their operations. This newfound efficiency allowed them to make faster, data-driven decisions, ultimately driving their growth and profitability. Automation turned out to be their ace in the hole, proving that even the biggest ships can change course with the right tools.

Common Challenges and Solutions

Navigating the world of automating financial reports can sometimes feel like trying to solve a Rubik’s cube blindfolded. But don’t sweat it, because I’m here to guide you through some common challenges and how to tackle them head-on.

Challenge 1: Resistance to Change and Human Error

Change can be as welcome as a skunk at a garden party, especially in the workplace. Resistance is natural, but there are ways to win over the skeptics. Start by highlighting the benefits of automation, like saving time and reducing errors.

Share success stories or case studies that your team can relate to, showing them the real-world perks. Involve them in the process early on and encourage open dialogue about concerns. Remember, a little empathy goes a long way in easing tensions and getting everyone on board.

Challenge 2: Data Security Concerns

Your data is precious, and the thought of it being compromised is enough to keep anyone up at night. To ensure your data stays safe and sound, choose software solutions that prioritize security with robust encryption and compliance with industry standards.

Regularly update your systems and educate your team on best practices for data protection. By creating a culture of security awareness, you can rest easier knowing your financial information is locked up tighter than Fort Knox.

Challenge 3: Initial Setup Hurdles

The road to automation can be bumpy at first, but these tips can help smooth out the transition. Break down the setup process into manageable steps, tackling one task at a time to avoid feeling overwhelmed. Engaging with the software provider for support and training can be a game-changer.

They can offer insights and tips to streamline the process. Lastly, be patient and flexible. Adjustments may be necessary, but with a little persistence, you’ll soon be cruising along with efficiency and ease.

[ad_2]